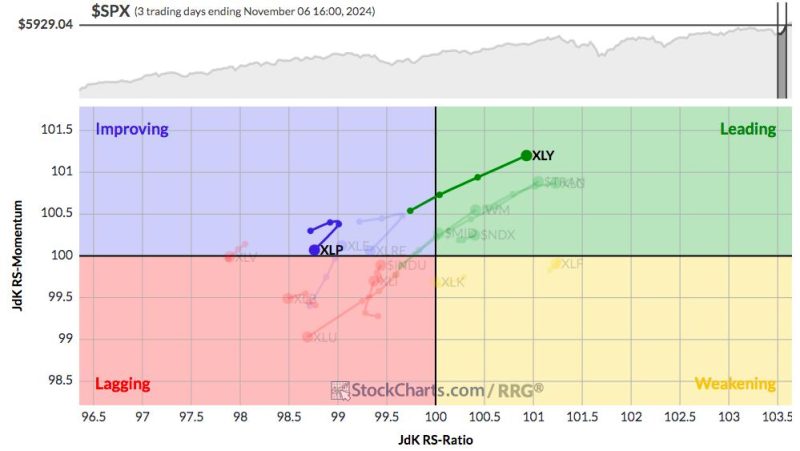

Enjoying these HUGE rallies is much easier when you have confidence the stock market is in a secular bull market and heading higher. It also helps when you enter a period of historical strength – the absolute best strength that we see anytime throughout the calendar year. This combination can be extremely powerful and we saw that combo result in surging U.S. equity prices last week. If we look at a daily RRG that includes our major indices and all sectors, you’ll see where the relative strength was:

I highlighted the relationship between consumer discretionary (XLY) and consumer staples (XLP) and you can see rather clearly the direction that each was headed on a relative basis last week. I’ll get to the significance of that in just a second, but I want to first highlight ALL of the areas in the leading and weakening quadrants. Remember, even those stocks in the weakening quadrant show relative strength. Leaders will sometimes pause in this quadrant before returning to the leading quadrant. This RRG highlights the areas of strength over the past few days (since Election Day):

If you’re a momentum trader, the above RRG is your cheat sheet.

There are plenty of trading strategies and scans to uncover solid opportunities. One very simple scan to consider is:

This is a scan of small and mid cap industrials stocks with average volume recently over 200,000 shares and excellent relative strength, at least based on StockCharts Technical Rank (SCTR) scores.

This scan returned 46 stocks, which is quite manageable, in my opinion. Here are the 10 returned having the highest SCTR scores:

These charts all look great, but many are very extended and overbought currently. I’d prefer keeping them on a Watch List and waiting for a pullback to perhaps rising 20-day EMAs before entering. Instead of buying companies with extended charts, here’s one that just made a key breakout:

ERJ is one of the best stocks in its industry group – aerospace ($DJUSAS). I believe it’s important to stick with industry leaders while their relative strength is in an uptrend. Once that reverses, it’s time to find new leaders.

We’ve been planning for this type of rotation to small caps, mid caps, financials, and industrials, and our two key portfolios, Model and Aggressive, illustrate beautifully the difference it makes when you’re positioned perfectly:

Our current quarter runs from August 19th through November 19th. We “draft” equal-weighted stocks in each portfolio every 90 days, which we’ll be doing again in a little over a week. Our Model Portfolio has TRIPLED the S&P 500 over the past 3 months and more than doubled the S&P 500 over the past 6 years. The Aggressive Portfolio, which typically invests in small and mid cap stocks, has absolutely exploded higher this quarter as these asset classes have become preferred groups. It’s on the verge of quadrupling the S&P 500 return. 25% return in a quarter goes a LONG way in helping you meet your financial goals.

Currently, the new leaders are as I spelled out earlier. You MUST take advantage of these opportunities when they present themselves. Next Saturday, November 16th, at 11:00am ET, I’m hosting a 100% FREE webinar, “Capitalizing on Small Cap and Mid Cap Strength”. CLICK HERE to register NOW and save your seat. Seating will be limited, so don’t miss out!

Happy trading!