The BC government plans to fast track 18 resource projects to reduce the province’s dependence on US trade.

According to the CBC, the mining and energy projects are worth around C$20 billion combined, and are expected to move through the approval process at an accelerated pace amid ongoing trade tensions with the US.

The government has identified resource-dependent communities as the primary beneficiaries, as they are most vulnerable to potential trade disruptions. The projects are expected to employ 8,000 people.

‘We have a huge advantage in British Columbia here with our geographic positioning,’ Premier David Eby said in an email to the CBC. ‘We know that we have what the world needs, and we’re going to use that to our advantage.’

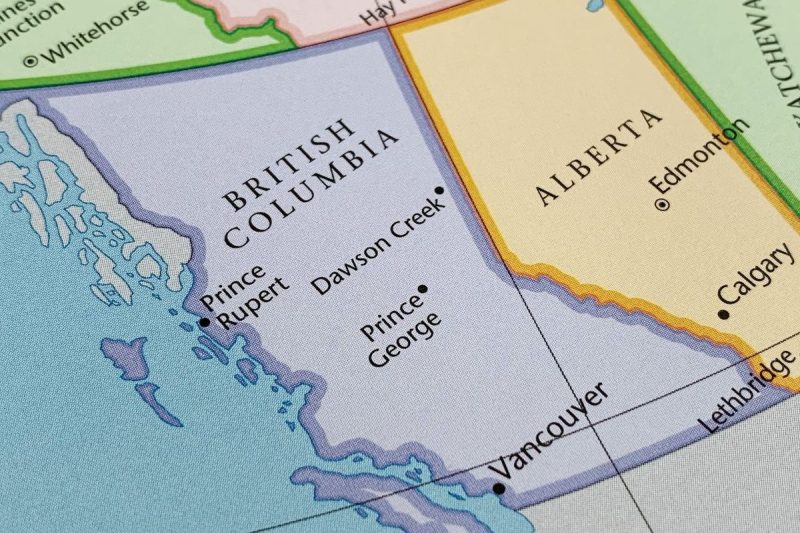

The properties include the Eskay Creek gold-silver project, a historic mine restart in Northwest BC, the expansion of the Red Chris gold-copper mine in the same region and the Highland Valley copper mine extension in Logan Lake.

Other projects cited are the Mount Milligan gold-copper mine near Fort St. James, the Cedar natural gas export facility in Kitimat and the NEBC Connector, a pipeline project transporting natural gas liquids from Northeast BC to Alberta.

BC Energy Minister Adrian Dix confirmed that the government will prioritize permitting and environmental assessments for these projects, though he emphasized that existing regulatory standards will be maintained.

‘It’s critically important that we move through these stages of the process, not to take away from standards, but to ensure that these projects happen in the fastest possible way,’ he said.

US export hub

According to BC Stats, the US accounted for 54 percent of the province’s exports in 2023.

Of those exports, 67 percent were in the wood, pulp and paper, metallic mineral and energy sectors. China and Japan were the next largest markets, representing 14 percent and 11 percent, respectively.

The BC government continues to evaluate additional projects for fast tracking, with further announcements expected in the coming weeks.

Fast tracked projects raise regulatory concerns

Some environmental groups have raised concerns about the fast-tracking decision.

The CBC quotes Jessica Clogg of West Coast Environmental Law, who suggests that economic uncertainty is being used to justify projects that may have otherwise faced greater scrutiny.

‘I do think it’s shameful that resource companies and the business sectors are taking advantage of the current economic instability to apparently put forward a list of potentially risky projects,’ she commented.

Several projects have also drawn opposition from Indigenous groups. The Eskay Creek and Red Chris mines have faced resistance from Alaskan Indigenous governments due to environmental concerns.

In BC, the Tahltan Nation has voiced dismay about the decision to fast track those projects, noting that they are both located in Tahltan territory and pointing to a lack of consultation.

“We fully acknowledge that developments in the United States have raised economic concerns in Canada and we share those concerns,” President Beverly Slater wrote in a February 7 statement.

“For the Tahltan Nation, our priority, as always, is ensuring that our Title and Rights, as well as our human rights, are fully upheld and respected. This involves properly assessing the economic, environmental, social, and cultural dimensions of any project proposed in our Territory consistent with any agreement that has been entered into by the Tahltan Nation and British Columbia pursuant to section 7 of the Declaration on the Rights of Indigenous Peoples Act.”

The expansion of the Highland Valley copper mine, owned by Teck Resources (TSX:TECK.A,TSX:TECK.B,NYSE:TECK) has been challenged by the Skeetchestn and Tk’emlúps te Secwépemc bands in BC’s interior.

Dix stated that consultations with Indigenous communities will continue. He noted that several wind power projects are structured to be at least 50 percent Indigenous-owned.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.